post

https://api.datakeen.co/api/v1/reco/tax-reference

This synchronous API extracts in real-time information from french tax reference:

Control categories

The control categories returned by the API are the following:

- Data coherency: Verifies the format and the content of the extracted information.

- Visual controls: Verifies the visual conformity of the document.

- Metadata: Verifies the metadata of the file to detect document alterations.

Status codes

The API returns the following status codes:

| Code | Code Name | Description |

|---|---|---|

| 1.0 | conform | The document has been fully verified by the AI, it is valid and conform |

| 2.1 | bluriness | The document could not be processed: Bluriness |

| 2.2 | readability | The document could not be processed: Could not read textual information |

| 4.0 | toVerify | We could not process all the controls on the given document, please review its authenticity |

| 5.0 | AIRejected | At least one element on the document is suspected to be fraudulent |

- Name of the taxpayer.

- Taxpayer fiscal number (numéro fiscal).

- Taxpayer fiscal reference (Référence de l'avis).

- Tax year.

- Taxpayer fiscal reference income (Revenu fiscal de référence).

- Taxpayer total salary over tax year.

- Taxable income.

- Number of shares.

- Secondary taxpayer name.

- Secondary taxpayer fiscal number.

- Secondary taxpayer total salary over tax year.

It also extracts control information on the fields above using the tax-reference 2ddoc :

- Conformity of the taxpayer fiscal number : Verify whether the extracted fiscal number adheres to the correct format.

- Conformity of the taxpayer fiscal reference : Verify whether the extracted fiscal reference adheres to the correct format.

- Conformity of the secondary taxpayer fiscal number (if it exists): Verify whether the extracted fiscal number adheres to the correct format.

- Checks if the taxpayer name match (between document and 2ddoc)

- Checks if the secondary taxpayer name match (between document and 2ddoc)

- Checks if the number of shares match (between document and 2ddoc)

- Checks if the taxpayer fiscal number match (between document and 2ddoc)

- Checks if the secondary taxpayer fiscal number (if it exists) match (between document and 2ddoc)

- Checks if the taxpayer fiscal reference income match (between document and 2ddoc)

- Checks if the taxpayer fiscal reference match (between document and 2ddoc)

- Checks if the tax year match (between document and 2ddoc)

Maximum file size: 5 MB. Maximum number of calls per minute: 10 calls.

Input document(s) can be either Black & White or colored.

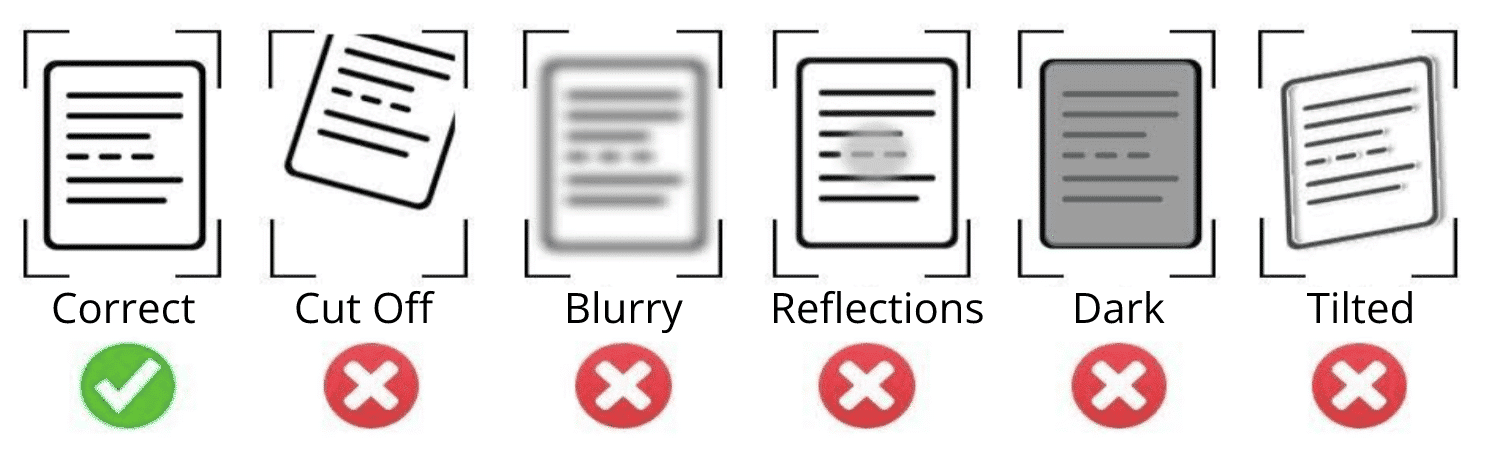

For better results, it is highly recommended to provide documents under these properties :

- The image resolution should be greater than 200 DPI

- The document must not be blurred or rotated

- In case of a photo document, make sure that the text area does not contain any highlights or shadows

- The entire document must be in the frame