post

https://api.datakeen.co/api/v1/reco/new/real-estate-wealth-tax-notice

This synchronous API extracts in real-time information from real estate wealth tax notice document:

- Nom du contribuable

- Adresse

- Revenu fiscal de référence

- Valeur nette taxable

- Montant de l'impôt

- Date de l'avis

- Numéros fiscaux

- Taux d'imposition

- Détails des biens immobiliers

- Détails des dettes déductibles

- Total des versements faits

Maximum file size: 5 MB. Maximum number of calls per minute: 10 calls.

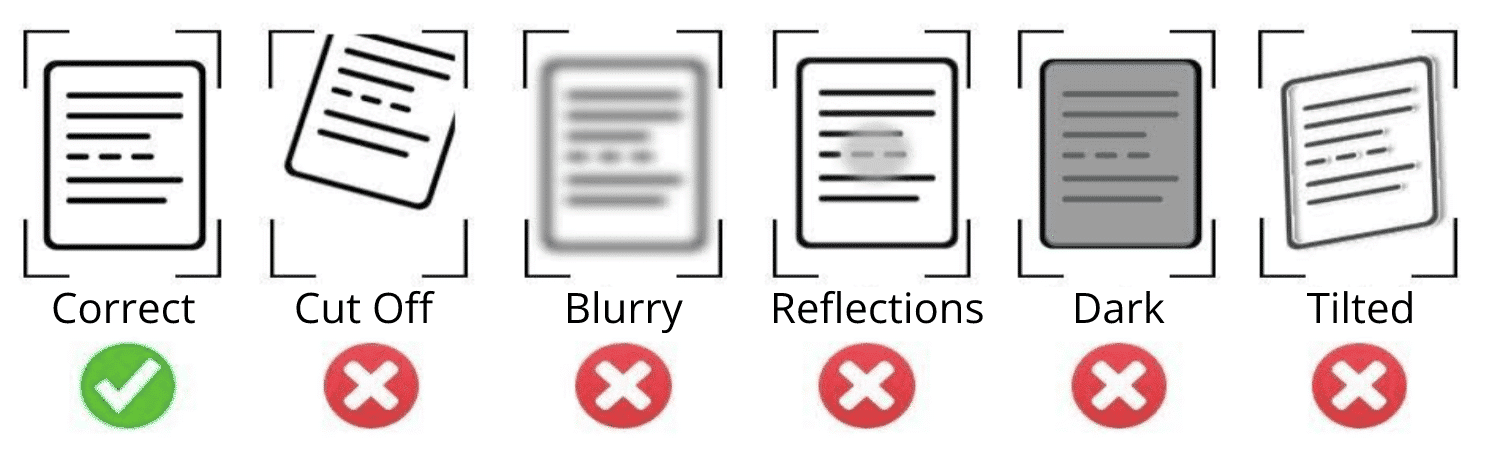

For better results, it is highly recommended to provide documents under these properties :

- The image resolution should be greater than 200 DPI

- The document must not be blurred or rotated

- In case of a photo document, make sure that the text area does not contain any highlights or shadows

- The entire document must be in the frame