This synchronous API extract in real-time relevant information from Real Estate Wealth Tax Notice document such as taxpayer's Name, Address, Reference Fiscal Income, Taxable Net Value, Tax Amount, Notice Date, Tax Numbers, Tax Rate, Real Estate Details, Deductible Debts Details and Total Payments Made.

Verifying Real Estate Wealth Tax Notice documents is important for several reasons. Firstly, it ensures that the taxpayer's information is accurate and up-to-date, which is crucial for tax calculations and assessments. Secondly, it helps in detecting any discrepancies or errors in the tax information provided by the taxpayer. Lastly, it allows for proper record-keeping and auditing purposes.

The extracted key information from Real Estate Wealth Tax Notice documents includes:

- Taxpayer's Name: The name of the taxpayer as mentioned in the document.

- Address: The address of the taxpayer as mentioned in the document.

- Reference Fiscal Income: The reference fiscal income of the taxpayer.

- Taxable Net Value: The taxable net value of the taxpayer's real estate.

- Tax Amount: The amount of tax to be paid by the taxpayer.

- Notice Date: The date of the tax notice.

- Tax Numbers: The tax numbers associated with the taxpayer.

- Tax Rate: The tax rate applicable to the taxpayer.

- Real Estate Details: Details of the taxpayer's real estate properties.

- Deductible Debts Details: Details of the taxpayer's deductible debts.

- Total Payments Made: The total payments made by the taxpayer.

Maximum file size: 5 MB.

Maximum number of calls per minute: 10 calls.

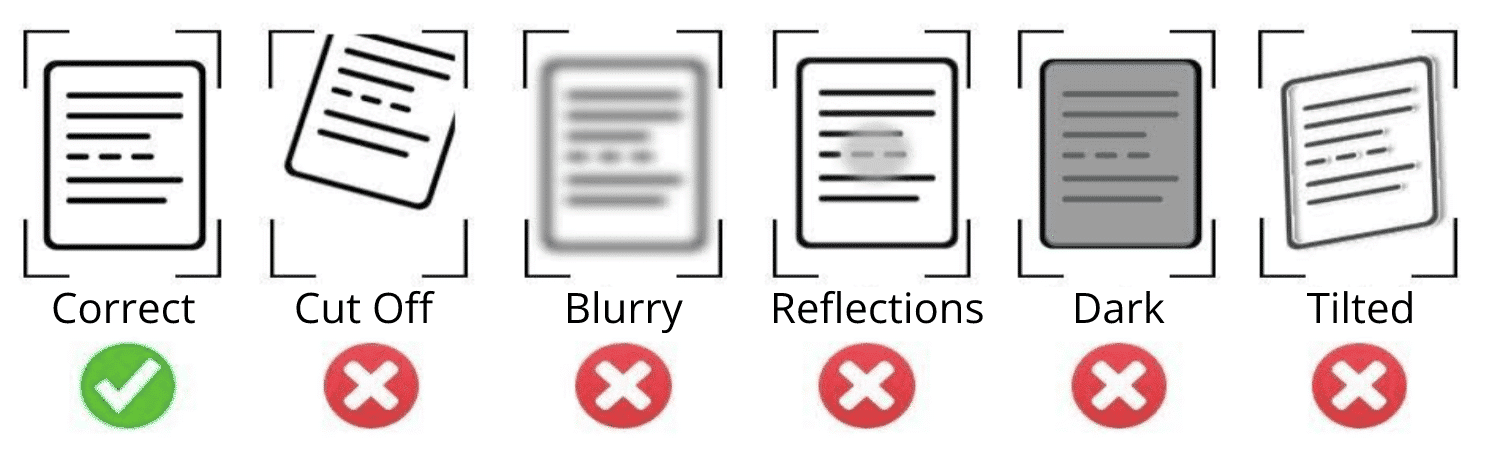

For better results, it is highly recommended to provide documents

under these properties :

- The image resolution should be greater than 200 DPI

- The document must not be blurred or rotated

- In case of a photo document, make sure that the text area does not contain any highlights or shadows

- The entire document must be in the frame